Michigan Tax Brackets 2025. Application for extension of time to file michigan tax returns: The michigan court of appeals has ruled that a reduction in the state income tax rate for the 2025 tax year will not be permanent.

In an effort to keep the rate at 4.05% through 2025. Per the irs, almost 44.6 million taxpayers have submitted their tax returns so far in 2025.

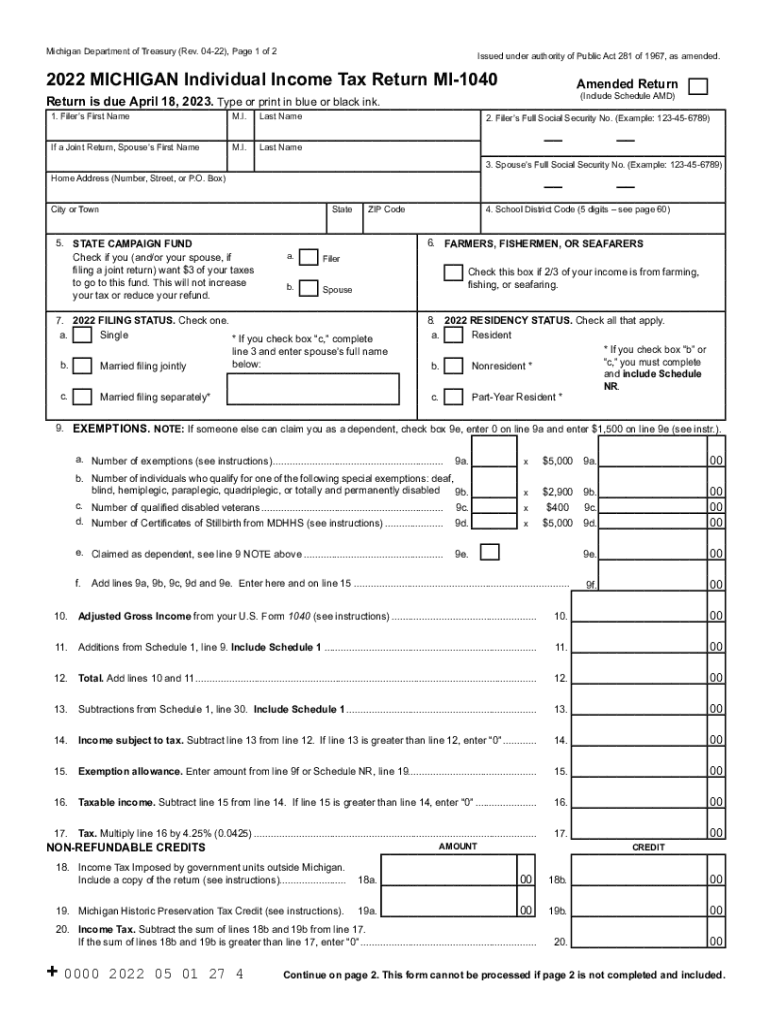

Michigan Tax Rate 20222024 Form Fill Out and Sign Printable, Your marginal federal income tax rate. For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers.

State Corporate Tax Rates and Brackets for 2025 Tax Foundation, The federal federal allowance for over 65 years of age head of household filer in 2025 is $ 1,950.00. In an effort to keep the rate at 4.05% through 2025.

Tax Rates 2025 To 2025 2025 Printable Calendar, For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers. This tool is designed for simplicity and ease of use, focusing solely on income.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in michigan. However, the rate will go back up to.

Tax Cuts are Coming, but Michigan is Already a LowTax State Citizens, The flat tax rate for withholding income tax from supplemental wages remains at 22% and at 37% for supplemental wages over $1 million during the calendar year. Beginning in tax year 2025 (for returns filed in 2025), michigan taxpayers will be able to choose either:

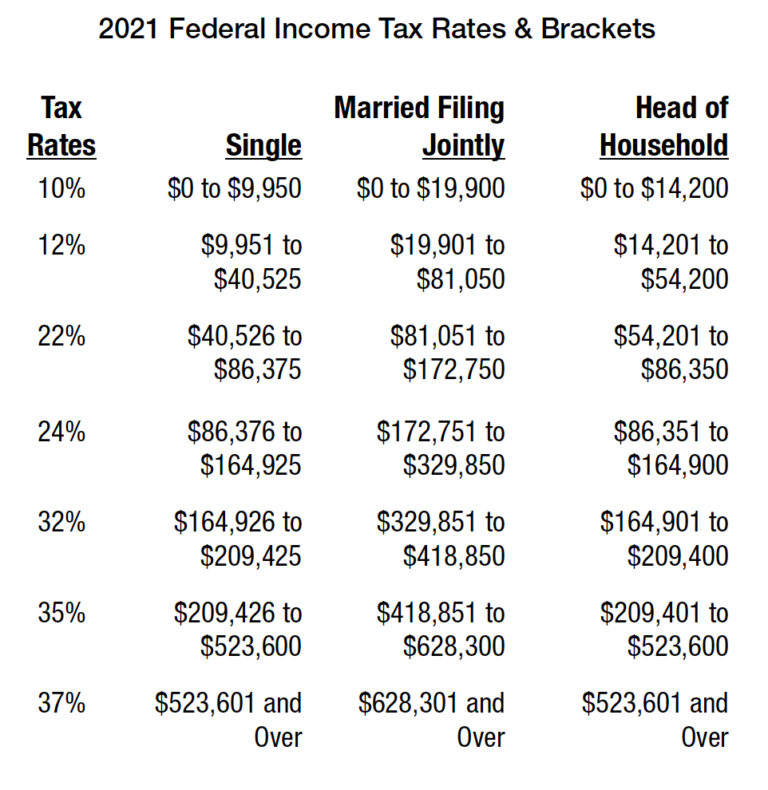

2025 Tax Bracket Changes PBO Advisory Group, Per the irs, almost 44.6 million taxpayers have submitted their tax returns so far in 2025. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

2025 Tax Bracket Changes and IRS Annual Inflation Adjustments, The court made the decision on. The michigan court of appeals has ruled that a reduction in the state income tax rate for the 2025 tax year will not be permanent.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, On a yearly basis, the internal revenue service (irs) adjusts more than 60. Application for extension of time to file michigan tax returns:

Michigan Family Law Support Jan 2025 2025 Tax Rates 2025 Federal, Here's how those break out by filing status:. Michigan residents state income tax tables for head of household filers in.

Understanding 2025 Tax Brackets What You Need To Know, Michigan has one individual income tax bracket with a flat rate of 4.05%. The michigan income tax has one tax bracket, with a maximum marginal income tax of 4.25% as of 2025.